Tackling the tax share together

Understanding the need for business tax relief

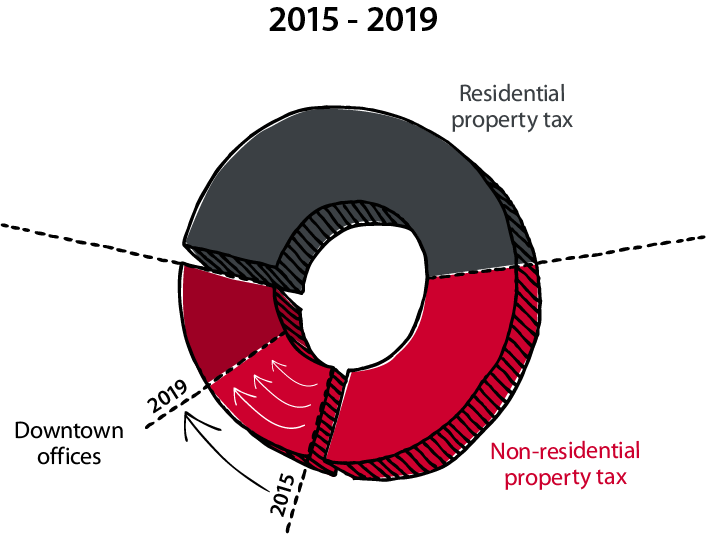

Businesses are vital in job creation and in creating vibrancy in our communities. Since 2015 the steep and rapid decline in the market value of a small number of high valued downtown properties resulted in a redistribution of property taxes ($250 million from 2015-2018) to other non-residential properties.

Office towers in the core provided 32 per cent of the total non-residential property tax revenue in 2015. In 2019, provides only 18 per cent.

Phased Tax Program for businesses

To support non-residential property owners and our local economy, City Council has approved over $259 million in one-time property tax relief to eligible non-residential properties that received the most significant municipal tax increases over the past five years. The Municipal Non-Residential Phased Tax Programs (PTP) have been one-time tax relief measures, but businesses needed a more permanent action or they would be facing large increases when the one-time property tax relief ended.

- Council approved $13 million in tax relief in 2021 that will benefit up to 2,000 non-residential property owners by capping their municipal tax increase to 10 per cent of their 2020 amount not including prior year’s rebate and prior year’s Phased Tax Program credits.

Learn more Municipal Non-Residential Phased Tax Program (PTP)

Long-term support for businesses and our local economy

While the Phase Tax Program provided immediate relief over the last five years, long-term solutions were needed to support businesses and our local economy.

Council has supported reducing the distribution of municipal tax for non-residential properties over-time and redistributed some of the tax responsibility in 2019. This change has helped keep businesses open, create jobs for Calgarians, and support our local economy.

Learn more on our municipal tax share page.