Annexation

Annexation is a provincially-legislated process governed under Municipal Government Act. Lands are transferred from one municipality to another to accommodate future urban growth and development.

Annexing land typically involves negotiations between local governments and consultation with landowners. The annexation is reviewed by the Land and Property Rights Tribunal and the Minister of Municipal Affairs for additional recommendations. The Minister of Affairs brings forward the annexation orders to Cabinet. If approved or approved in part, the Lieutenant Governor of Alberta signs the order.

To learn more about the annexation process, visit the Land and Property Rights Tribunal website.

-

Learn more about City Council unanimously agreeing to proceed with plans to initiate the annexation process for land east of Calgary.

Calgary annexations

Annexation has been a primary means by which our city has grown and part of Council efforts to maintain a supply of developable land for future growth.

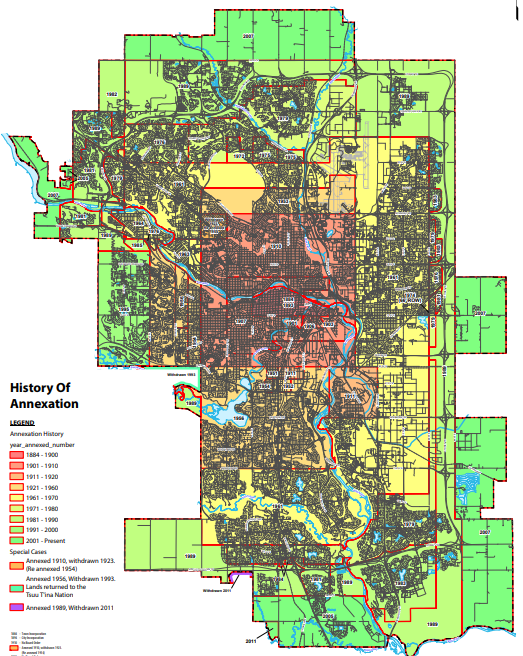

Learn how we plan for Calgary's future or view the History of Annexation map.

While the annexation of land does not mean immediate development or urbanization, landowners do receive services not offered by rural municipalities.

Municipal property taxes enable The City to deliver services such as Police, Fire & Emergency Response and roads, but it also helps pay for other things including parks, and recreation facilities.

User fees for services, such as water, wastewater, and waste & recycling, are provided as lands are further developed or where services can be provided logistically while remaining fiscally responsible.

To learn more about all our City services and programs.

Calgary annexation board orders

Properties or parcels of land annexed into The City are protected by the annexation provisions described in the board order through which it was annexed.

Currently, there are three active annexation board orders within The City. Each annexation order may provide special assessment and taxation consideration to City lands. These orders include:

| Board Order | Board order or clause expiry | Previous Municipality | Property assessment | Tax clause | Clauses that may disqualify a property from special provisions under annexation |

|---|---|---|---|---|---|

| OC 999-196125860 | N/A |

|

FH, RVC | RVC rates |

|

| OC 999-195620027 | N/A | RVC | RVC | RVC rates |

|

| OC 487-1995 | Dec 31, 2025 | RVC | RVC | RVC rates expire Dec 31, 2025 |

|

| OC 333-2007 |

|

RVC | CGY 2007 | RVC rates expired Dec 31, 2021 |

|

Legend: Calgary (CGY), Foothills (FH) and Rocky View County (RVC)

Complete board orders can be found on the Land and Property Rights Tribunal website

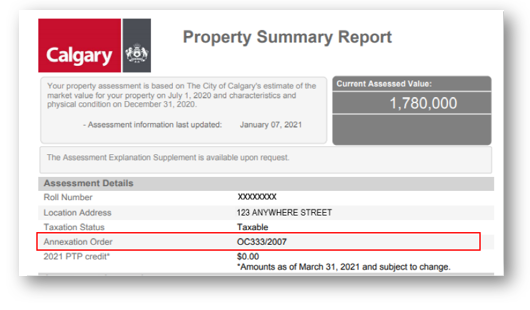

Find your property's annexation order

myTax is our online resource for property and business owners to access and review their assessment and tax information.

Important information

What can impact an Annexation order?

What can impact an Annexation order?

Board orders typically provide clauses under which properties may be disqualified from special provisions afforded by being under annexation. The clauses for disqualification vary depending on the board order but may include actions such as:

- Re-zoning

- Development

- Subdivision

- Connecting to City services (water or wastewater)

Once a property is removed from a board order, it becomes subject to The City assessment values and taxation rates.

How are annexation properties valued?

How are annexation properties valued?

These properties are valued based on the provisions of specific annexation orders. Currently, there are four annexation orders that provide special assessment and taxation consideration to City lands.

Each annexation order may provide a 'clause' that directs a municipality to utilize a value as if the property still exists within that municipality.

If you have questions about your property's assessment contact Assessment.

How does The City put municipal property tax dollars to good use?

How does The City put municipal property tax dollars to good use?

Municipal property taxes are the primary way The City delivers services and programs that Calgarians need and value every day. We want you to know how these dollars are collected, calculated and used to provide City services.

Delivering value through our City services and programs requires proper planning throughout the year. Learn more about the process, how tax dollars get invested wisely, and the steps we're taking to modernize and reduce the cost of local government.

Questions & answers

What is Annexation?

Annexation is a provincially-legislated process governed under Municipal Government Act. Lands are transferred from one municipality to another to accommodate future urban growth and development. The new municipality provides services and their regulatory authority to protect public health and safety.

How is land annexed in Alberta?

In Alberta, annexations are regulated by the Land and Property Rights Tribunal (formerly Municipal Government Board). The annexation process involves negotiations between local governments, public engagement with property owners, a formal review by the Land and Property Rights Tribunal and the Minister of Municipal Affairs. The Minister of Municipal Affairs brings forward the annexation orders to Cabinet. If approved or approved in part, the Lieutenant Governor of Alberta signs the order. Further details about the annexation process can be found on the Land and Property Rights Tribunal website.

Why does The City annex properties?

Annexation helps ensure key elements of The City’s long-term growth requirements, strategic interests and future opportunities are achieved, including:

- Safeguarding The City’s ability to accommodate its significant rate of growth

- Maintain and expand a variety of growth directions to promote competition in the residential marketplace, provide a measure of housing affordability, and provide more certainty to maintain The City’s historic growth management approach.

- Developing a relatively compact, contiguous, efficient, and cost-effective urban form that mitigates sprawl and benefits the Calgary region.

- Promoting fiscal fairness and equity in the Calgary region through an approach to governance whereby all urban development remains under one municipal jurisdiction.

- Protecting key environmental and watershed corridors.

Annexation remains one of the primary means by which our city has grown, see the History of Annexation Map for an overview of Calgary’s growth.

What value does annexation bring Calgary and landowners?

Creating urbanized areas enhance major services, including the planning of transportation and utilities services, uses resources more efficiently, captures growth, gains a tax base and helps with regionalization. Landowners receive enhanced and additional services and programs not typically offered by rural municipalities.

Does annexation mean immediate development?

Annexation of land does not mean immediate development or urbanization. Development and urbanization are a product of inputs such as planning, servicing and market demand. The City has a well-developed process to realize development in locations that are or can be serviced with high-quality urban infrastructure such as transportation, safety, and utilities.

As development and urbanization takes place, residents and businesses are further exposed to a wide range of services not offered by rural municipalities.

Municipal property taxes enable The City to deliver services such as Police, Fire & Emergency Response, and roads, but it also helps pay for other things, including social programs, and recreation facilities.

User fees services, such as water, wastewater, and waste & recycling, are provided as lands are further developed or where services can be provided logistically while remaining fiscally responsible. Learn more about all our City services and programs.

How does Calgary plan for future growth and development?

The Municipal Development Plan (MDP) and Calgary Transportation Plan (CTP) are The City’s long-range land use and transportation plans that look 60 years into the future. The Plans help shape how the communities we live and work in grow, develop and evolve over time. The MDP and CTP were updated in 2020 as our city continues to change and grow.

The City has also begun a process to consult with local community members and businesses to plan for future development at the community level through the Local Area Planning process. The City currently has over 200 policy documents that guide local area development and redevelopment within the city. The Local Area Plan process anticipates revisiting those 200 policy documents and implements approximately 42 local area plans, which will direct where and how we develop the city within its current boundaries. This process is anticipated to be approximately a ten-year-long process and will generally begin in areas within the inner-city and work outwards towards the municipal boundaries. Our long-range plans make sure City staff, communities, developers, business owners, citizens and Council are working together to build a great city. Learn more about Planning for Calgary’s future.

What communities are properties referenced in Annexation Order OC 487-1995 located in?

Properties annexed in OC 487-1995 are located in Springbank Hill, Aspen Woods, Cougar Ridge, West Springs, Discovery Ridge, Coach Hill and residual areas to the west of the city.

What types of properties are included in Annexation Order OC 487-1995?

The properties are a mix of everything. Predominantly residential acreages, vacant residential lots, farm land, special purpose land, recreational and Institutional properties.

How are properties covered in Annexation Order OC 487-1995 valued?

Properties covered in Annexation Order OC 487-1995 have continued to be assessed and taxed by The City of Calgary on the same basis as if the property had remained within the Rocky View County. Once the annexation order expires on December 31, 2025, the annexed properties will be assessed using the market value valuation standards and subject to the same taxation rates as comparable properties in the city of Calgary.

The January 2026 assessment notice will be based on the market value standard and used to determine the share of property tax. Then The City’s municipal and provincial property tax rate will be applied to these accounts based on the property type (residential, non-residential, or farmland) when the tax bills are mailed in May 2026.

When will the municipal tax rate for properties annexed in 1995 change?

The taxation clause under the Annexation Order 487-1995 provides the impacted properties a Rocky View County tax rate for 30 years, which will expire on December 31, 2025. After this date, The City of Calgary municipal and provincial property tax rates will apply to the annexed properties identified. All property types affected by this annexation order will see an increase in their property tax.

Why were the Rocky View Municipality tax rates maintained for the past 30 years, and were landowners consulted?

Per the LAND AND PROPERTY RIGHTS TRIBUNAL (alberta.ca) procedures, The City negotiated with Rocky View County regarding the lands proposed to be annexed in 1995. This included consulting with landowners on the future assessment and taxation of annexed lands. The assessment and taxation system is legislated to ensure fairness in the taxation of property. The City and Rocky View County explored various options with landowners to mitigate the financial and potential tax impacts of annexation. This included maintaining the Rocky View County tax rate for 30 years, which was added to the conditions of the annexation and confirmed by the Lieutenant Governor in Council in 1995.

How does The City put municipal property tax dollars to good use?

Municipal property taxes are the primary way The City delivers services and programs that Calgarians need and value every day. We provide a wide range of City services not offered by rural communities. The City is working to educate Calgarians on how these dollars are calculated, collected, and used to provide City services. Delivering value through our City services and programs requires proper planning throughout the year.

City tax-supported services

- Police Services: Crime prevention and education, law enforcement and criminal investigations to make Calgary a safer place.

- Fire & Emergency Response: Responds to fires, emergencies, accidents, hazards & specialized rescues

- Public Transit: Safe, effective, reliable and affordable public transportation. Including supporting specialized transit.

- Streets: Building & maintaining Calgary streets, & keeping you safe with reliable roads

- Sidewalks & Pathways: Plans, designs, builds & maintains sidewalks & pathways to keep you moving

- Parks & Open Space: Manages Calgary's parks, urban green spaces and natural areas. In addition, cemeteries and urban forestry services.

- Recreation Opportunities: Recreation, sports & leisure & registered programs for a healthy Calgary

- Affordable Housing: Safe and affordable homes for lower-income Calgarians

- Citizen Engagement & Insight: Safe, fair & accessible feedback & participation in our government

- Social Programs: Services in communities to support, protect and enrich Calgarians' lives

Review all tax-supported and user-fee City services and programs at calgary.ca/services. Learn more on calgary.ca/ourfinances.

Is Calgary’s residential property tax competitive with other major municipalities in Canada?

Calgary continues to maintain below-average residential property taxes relative to a cross-section of major Canadian cities and regional neighbours for a representative two-storey house. Learn more about how our property tax and utility charges measure up nationally.

Does The City offer any programs to assist residential property owners in need?

Residential property owners experiencing financial hardship, regardless of age, may be eligible for a credit/grant of the increase on your property tax account. To learn more about the eligibility of this program, please visit Property Tax Assistance Program (calgary.ca).

What is the historical background of the 1995 Annexation?

In 1988, The City of Calgary applied for a comprehensive annexation to the then Local Authorities Board. The annexation application included the East Springbank area to the west of the city of Calgary. Following numerous public meetings, planning studies and draft plans, The City and Municipal District (MD) of Rocky View adopted the East Springbank Joint General Municipal Plan in May 1994.

The City of Calgary formally initiated the annexation by giving written notice to the MD of Rockyview on January 6, 1995. Copies of the notice were sent to the Municipal Government Board (MGB) and all affected local authorities. The notice included a description of the lands proposed for annexation, reasons for the annexation, and proposals for consulting with landowners and the public. In addition, The City gave notice that an inter-provincial municipal negotiations committee composed of representatives of The City and MD of Rockyview had been established.

A series of public meetings were held between November 1994 and March 1995. The public meetings were advertised in the Calgary Rural Times, Rocky View Five Village Weekly and the Calgary Herald. Representatives from the MD of Rocky View, City of Calgary, effected school boards and residents attended the meetings. The purpose was to provide information about the proposed annexation, solicit comments and identify issues that needed to be addressed through the negotiation process.

In addition to the public meetings, The City mailed newsletters to interested parties to create awareness of decision to proceed with the annexation, announce the dates of public meetings, and provide information on the progress of inter-municipal negotiations, decisions and impact of those decisions.

The agreement was signed by the City of Calgary and MD of Rocky View on April 3, 1995. On April 12, 1995, The City of Calgary filed a negotiation report with the MGB. The negotiated settlement between The City and MD of Rockyview included a joint request for certain assessment conditions to be attached to the annexation that addressed the concerns of landowners and a compensation package for the MD. In addition, The City and MD requested that the annexation be made effective July 1, 1995.

The MGB advised The City, MD of Rockyview and affected local authorities that there appeared to be general agreement with the annexation and that if no objections were received by May 19, 1995, the Board would make its recommendation to the Minister. No objections were filed by any of the notified parties, resulting in approval of the annexation agreement, as recommended by the Municipal Government Board.

How can I request or inquire about other City services not related to my property's assessment?

Please contact 311 to discuss any additional City service inquiries you might have that are not related to your property's assessment.

The City provides services and programs to annexed properties that are logistically and financially feasible. Each location is unique, and some services might be provided while others require further urban development.